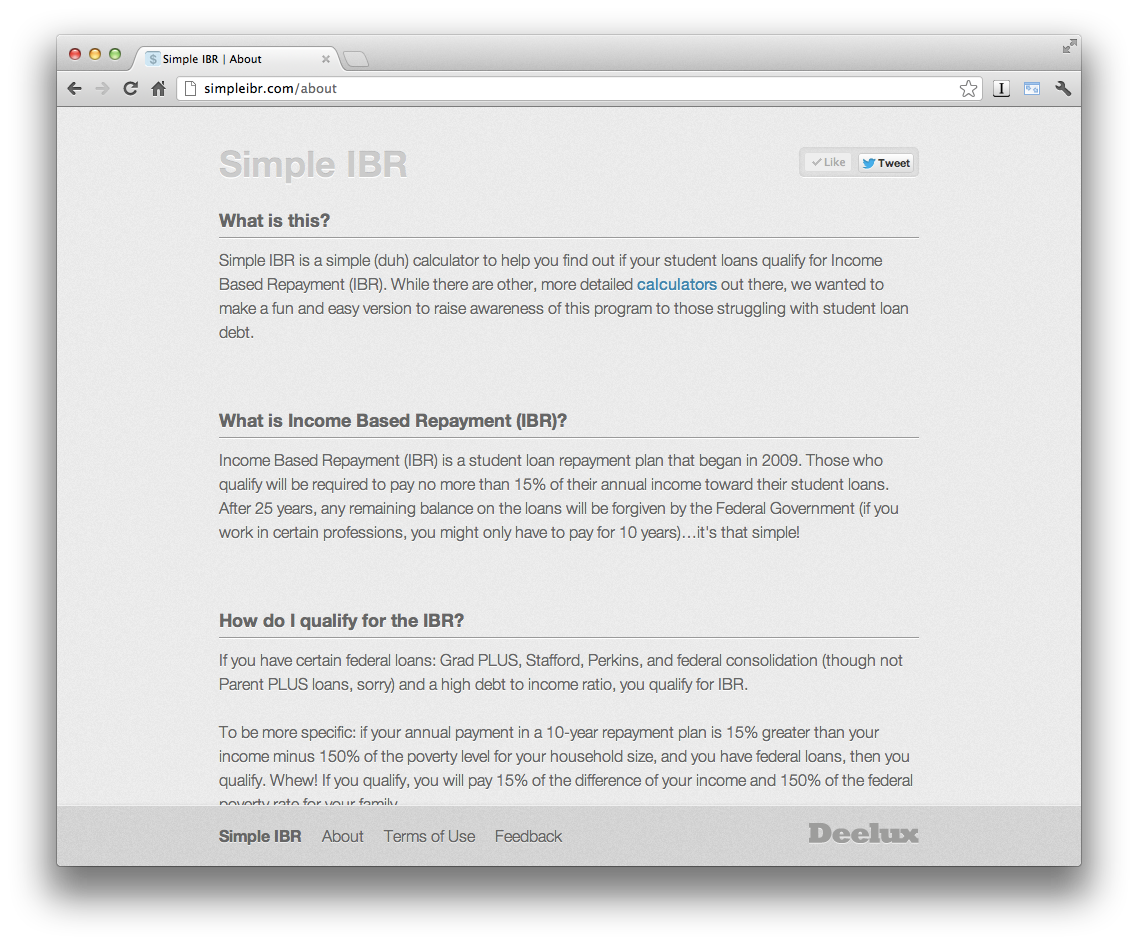

Chelsea and I carry significant student loan debt, and without the Income Based Repayment (IBR) program, we'd be buried under a high monthly payment. The IBR caps your student loan payment at 15% of your annual income, and discharges any remaining debt after 25 years. We were surprised that more of our friends in our situation were unaware of IBR. We took a stab trying to make the IBR understandable and approachable with SimpleIBR.

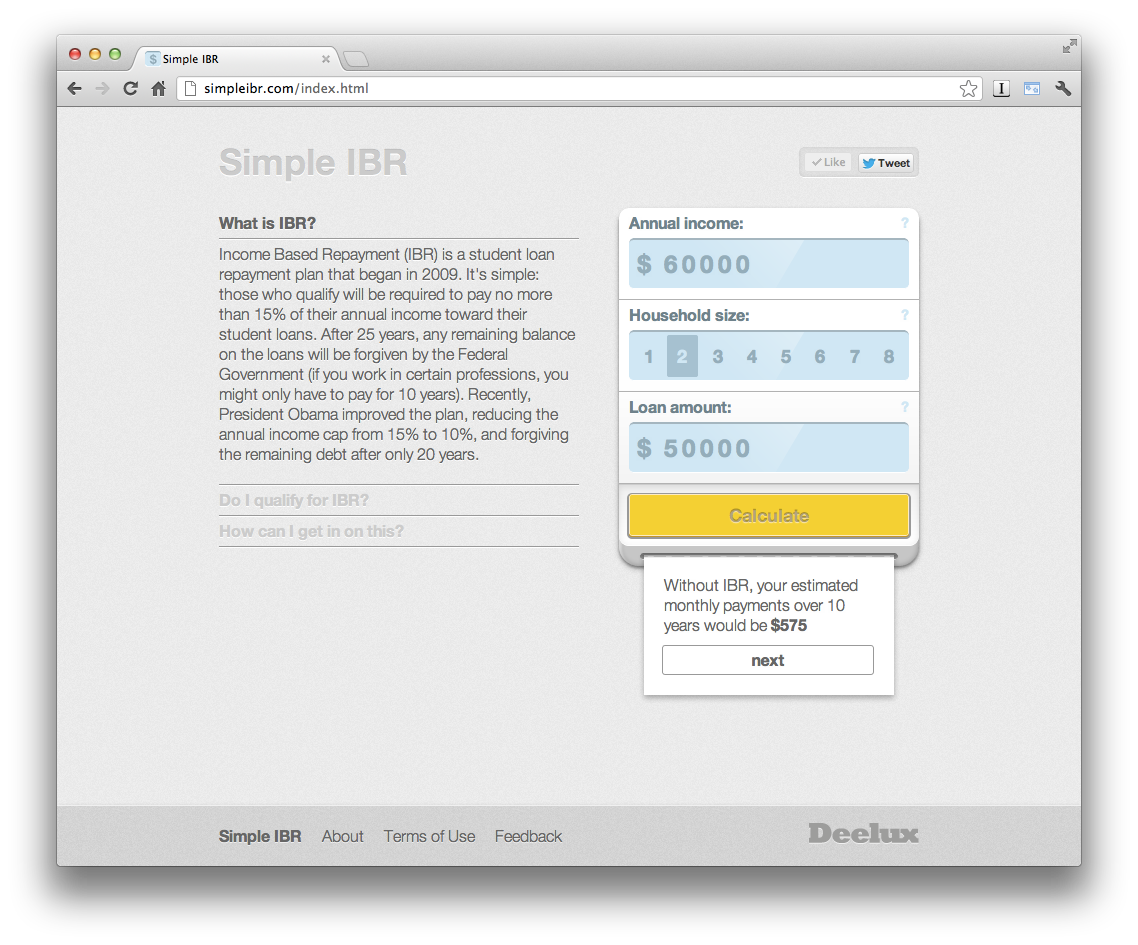

After carefully examining the documentation about the IBR, we broke down the calculation down to its simplest inputs: income, family size, and size of loan. This is the least you need to calculate program eligibility and a monthly payment.

Check it out: www.simpleibr.com

Initial mockups broke the individual components into discrete modules...

...and the "receipt" was more elaborate.

Eventually, the modules combined into a single panel. The narrow right-hand calculator emerged in the development phase of the project.